In terms of borrowing funds, knowing the choices available to you is crucial. Two prevalent varieties of financial loans are private financial loans and installment loans. When each assist you to borrow a sum of money, the stipulations bordering these loans can vary. A private mortgage is usually unsecured, meaning it isn't going to involve any collateral. These loans may be used for a variety of reasons, from personal debt consolidation to funding unanticipated costs. The flexibleness in use and also the mounted repayment agenda make individual loans captivating to many borrowers.

An installment mortgage, Then again, is usually a loan that's paid out off in frequent, mounted installments with time. It could be secured or unsecured, depending on the kind of mortgage. As an example, automobile loans and personal loan mortgages are secured installment loans, while personalized installment loans may be unsecured. Installment loans are created with distinct needs in mind, including acquiring an automobile or buying a home, as well as their repayment schedules are established beforehand.

1 important difference between both of these financial loan sorts is how the cash are employed. Individual loans are really adaptable, letting borrowers to make use of the funds for virtually any reason they need. No matter whether you happen to be consolidating financial debt or funding a sizable purchase, a private mortgage provides the liberty to choose how the money is expended. In contrast, installment financial loans are sometimes earmarked for particular buys. As an example, an auto financial loan is utilized especially for acquiring a vehicle, plus the mortgage conditions are structured about the quantity needed to finance the motor vehicle.

An additional difference lies in the repayment framework. Both loans have set repayment schedules, although the duration and level of Each individual payment may vary. Own loans have a tendency to acquire shorter repayment periods when compared with installment financial loans. Installment financial loans frequently have more time conditions, especially when used to finance massive buys like households. Whilst the extended bank loan time period can make month-to-month payments decrease, it could bring about paying much more curiosity after a while.

Fascination fees are an important consideration when deciding in between private and installment loans. Personalized loans, currently being unsecured, are inclined to own increased fascination costs when compared to secured installment financial loans. Considering that there isn't a collateral included, lenders take on a lot more danger, which often leads to bigger expenditures for that borrower. In contrast, secured installment loans which include home loans and auto loans often feature decrease curiosity rates as the bank loan is backed by an asset, supplying the lender with added protection.

In the end, selecting concerning a private loan and an installment personal loan is dependent upon your particular financial desires. If you need resources for many different reasons, a private loan can be the best choice. Conversely, if you're looking to finance a certain buy, for instance a house or auto, an installment mortgage is likely to be a lot more correct. Knowing the conditions, interest costs, and installment loan repayment schedules connected with Each individual sort of financial loan is essential to making the ideal choice on your economical scenario.

Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Robbie Rist Then & Now!

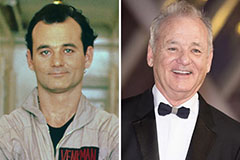

Robbie Rist Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Catherine Bach Then & Now!

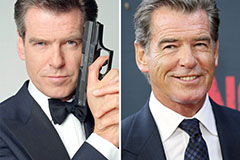

Catherine Bach Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!